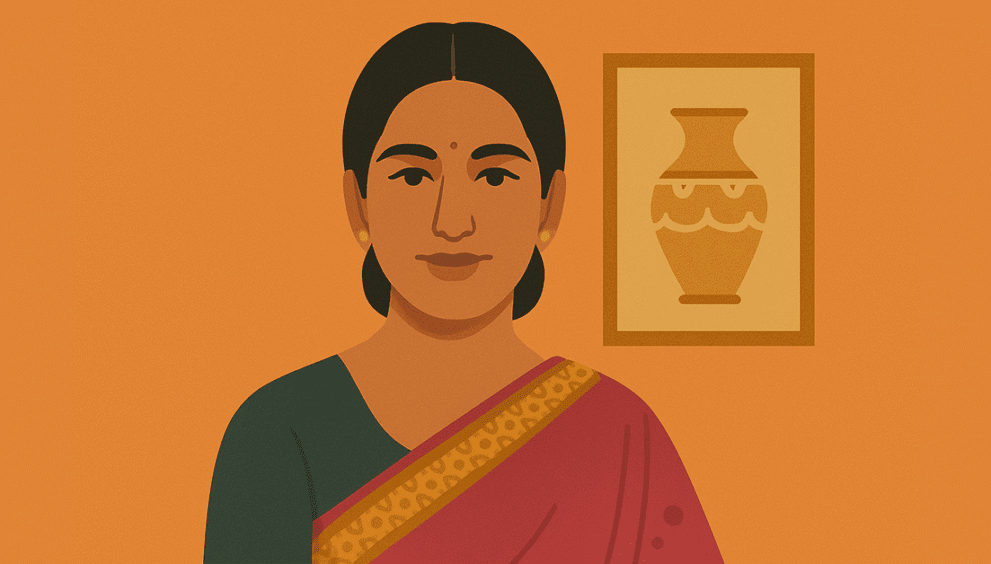

🧵 Palak Shah — Weaving India’s Heritage into Global Luxury with Ekaya Banaras

🔍 Who is Palak Shah?

Palak Shah isn’t just preserving Indian handloom traditions — she’s elevating them. As the Founder & CEO of Ekaya Banaras, Palak has turned her family’s multi-generational textile legacy into a globally admired luxury brand, reshaping how the world sees Banarasi weaves.

At just 21, Palak stepped into her family’s heritage business. But instead of running it the traditional way, she brought contemporary design, modern retail thinking, and a bold vision to the table. Today, Ekaya is one of India’s most respected luxury labels — blending old-world craftsmanship with modern fashion narratives.

🧶 What is Ekaya Banaras?

Founded in 2012 and reimagined under Palak’s leadership, Ekaya Banaras is a design house that works directly with master weavers from Varanasi, turning intricate handwoven textiles into ready-to-wear, couture, and bespoke collections.

Key differentiators:

- Weaver-first model — Ekaya eliminates middlemen to ensure artisans are paid fairly and consistently.

- Design innovation — Infusing age-old motifs with modern silhouettes.

- Storytelling-led retail — Every product comes with context, culture, and a celebration of heritage.

From handwoven saris to Banarasi-inspired jackets, dresses, and even western couture, Ekaya has redefined what “luxury from India” can look like.

📈 The 2025 Brand Footprint

In 2025, Ekaya operates multiple flagship stores in India and has made its mark in global markets through:

- Collaborations with international designers and fashion houses

- Showcases at fashion weeks and cultural exhibitions across Paris, London, and New York

- Online global store catering to NRIs and design connoisseurs

- A booming bridal and bespoke segment

Under Palak’s guidance, Ekaya has also introduced sustainable collections, featuring organic dyes and handspun yarns — bringing eco-consciousness into Indian luxury.

👗 Palak’s Vision as a Young Cultural Leader

Palak represents a rare blend of fashion entrepreneur and cultural revivalist. She’s often invited to speak at global forums on heritage, fashion, and women in business.

Her leadership style includes:

- Deep respect for grassroots talent

- Curated modernity — balancing tradition without diluting it

- Empowering rural artisans, especially female weavers, through design training and financial independence

She believes luxury should not just be defined by price or prestige — but by purpose, process, and people.

🗣️ What the Fashion & Cultural World Says

“Palak Shah has done what few others dared — turned the Banarasi weave into a globally relevant design movement.” — Fashion Editor, Elle India

“Ekaya is where storytelling meets soul. Every fabric has a heartbeat.” — Wedding Stylist, Mumbai

“Palak’s efforts in putting weavers on the map are as impactful as any fashion campaign we’ve seen.” — Cultural Researcher, UK India Council

🔮 What’s Ahead in 2025?

Palak is now:

- Launching Ekaya Studio — a platform for limited-edition, cross-cultural collaborations

- Opening experience centers where customers can see live weaving, design, and draping

- Expanding into home textiles and decor, making Banarasi a lifestyle identity

- Advocating for Geographical Indication (GI) protection and stronger policy support for Indian textiles

There’s also a documentary in production chronicling Ekaya’s impact on India’s handloom revival — expected to release by end of 2025.

💡 Why Her Work Matters

In a market flooded with fast fashion and fleeting trends, Palak Shah is building timeless value. By making Indian textiles desirable to a new generation — without losing their soul — she’s crafting a business that’s rooted in pride and powered by progress.

Through Ekaya, she’s not only reimagining Banarasi silk — she’s inspiring a generation of founders to look inward for their next big idea.

📢 More such inspiring journeys coming soon on 100X Venture Hub.

Disclaimer

This content is AI-altered, based on generic insights and publicly available resources. It is not copied. Please verify independently before taking action. If you believe any content needs review, kindly raise a request — we’ll address it promptly to avoid any concerns.