Understand the key metrics that drive real business growth

🧠 Introduction: ROAS vs ROI — Why You Can’t Afford to Confuse Them

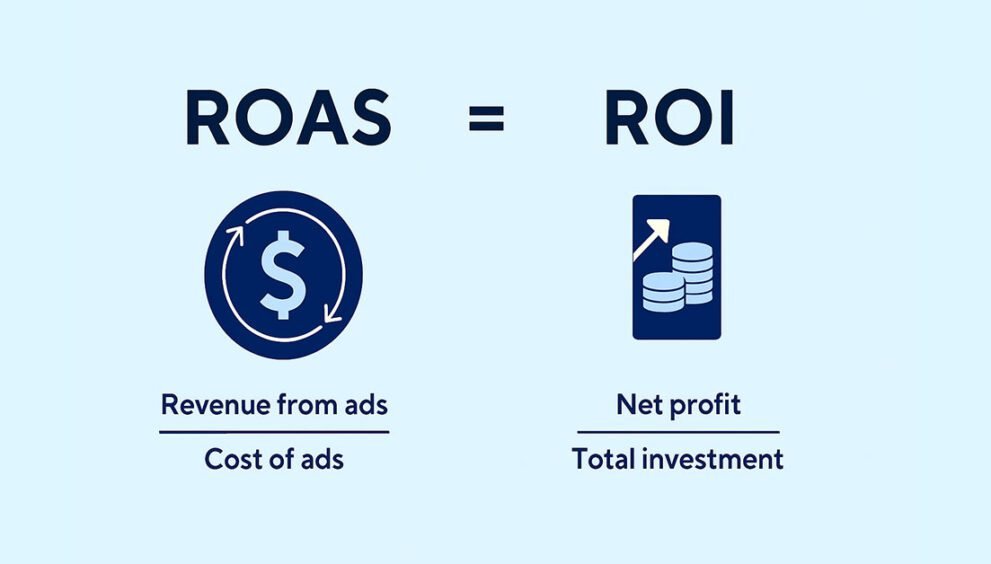

In the world of digital marketing, metrics are everything. But two often-confused terms—ROAS (Return on Ad Spend) and ROI (Return on Investment)—can make or break your campaign evaluation.

Both measure returns. Both involve spend. But they are not interchangeable.

In this guide, we’ll break down:

- What ROAS and ROI mean

- How to calculate each

- When to use which metric

- Real-world examples

- And how to make smarter business decisions using both

Let’s dive in.

💡 What is ROAS?

ROAS (Return on Ad Spend) measures the revenue generated per dollar spent on advertising.

➗ ROAS Formula:

iniCopyEditROAS = Revenue from Ads / Cost of Ads

✅ Example:

If you spent ₹10,000 on Google Ads and earned ₹40,000 in revenue:

iniCopyEditROAS = ₹40,000 / ₹10,000 = 4.0 (or 400%)

That means you earned ₹4 for every ₹1 you spent.

💰 What is ROI?

ROI (Return on Investment) calculates the net profit made from any investment, not just advertising.

➗ ROI Formula:

iniCopyEditROI = (Net Profit / Total Investment) × 100

✅ Example:

Let’s say your ad campaign cost ₹10,000. But you also spent ₹5,000 on website hosting, staff time, and tools. If your revenue was ₹40,000, your net profit is:

javaCopyEditNet Profit = ₹40,000 - ₹15,000 = ₹25,000

ROI = (₹25,000 / ₹15,000) × 100 = 166.7%

So your ROI is 166.7%, while your ROAS is 4.0.

🔍 Key Differences: ROAS vs ROI

| Metric | ROAS | ROI |

|---|---|---|

| Measures | Revenue from ads | Net profit from all investments |

| Scope | Advertising only | Business-wide investment |

| Simpler? | Yes | No – Includes total cost and profit |

| Use Case | Ad platform performance | Business viability and financial health |

| Formula | Revenue / Ad Spend | (Profit / Total Investment) × 100 |

🎯 When Should You Use ROAS?

Use ROAS when:

- You want to compare performance across ad channels (e.g., Facebook vs Google)

- You’re analyzing ad efficiency in real-time

- You’re setting Target ROAS bidding in Google Ads

It’s ideal for campaign-level decisions.

💼 When Should You Use ROI?

Use ROI when:

- You’re evaluating overall profitability

- You want to account for operational, team, or tech costs

- You’re pitching business results to stakeholders or investors

It’s best for high-level strategy and finance planning.

⚠️ Common Mistake: Relying Only on ROAS

ROAS can be misleading.

You might have a high ROAS, but if your profit margin is low or your backend costs are high, your actual profit (ROI) could be negative.

💬 “A campaign with a 6x ROAS might still lose money if the product has low margins or huge logistics costs.”

Always look beyond revenue.

📌 Final Thoughts: Use Both—Strategically

Think of it this way:

- ROAS = Tactical clarity

- ROI = Strategic clarity

Successful businesses track both and use them at different layers:

- Marketing Teams: Focus on ROAS for channel and campaign performance

- Founders/CMOs/Finance: Focus on ROI to decide if the business is profitable

🧰 Bonus Tip: Use This Simple ROAS vs ROI Checklist

| Task | Metric to Use |

|---|---|

| Testing new ad creatives | ROAS |

| Budget allocation for Q4 | ROI |

| Scaling Facebook campaigns | ROAS |

| Deciding to launch a new product | ROI |

| Justifying marketing spend to CFO | ROI + ROAS |

Disclaimer

This content is AI-altered, based on generic insights and publicly available resources. It is not copied. Please verify independently before taking action. If you believe any content needs review, kindly raise a request — we’ll address it promptly to avoid any concerns.