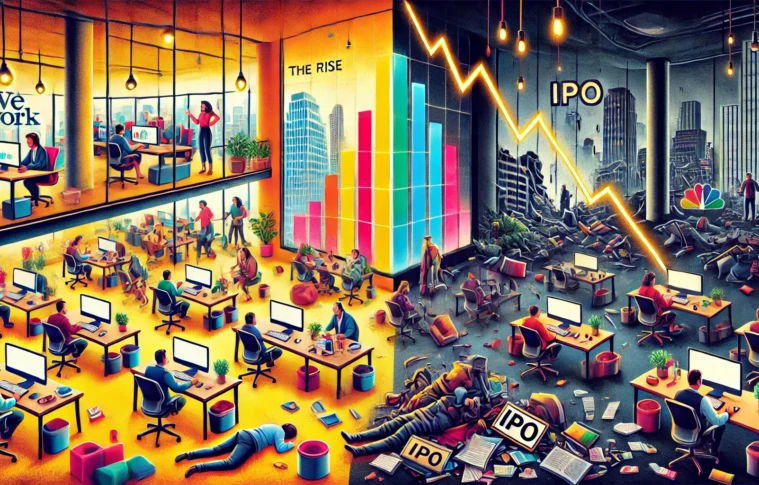

WeWork, a once-celebrated startup in the co-working space sector, quickly became one of the most high-profile failures in the world of startups and IPOs. Founded in 2010 by Adam Neumann and Miguel McKelvey, WeWork was initially seen as an innovative disruptor in the commercial real estate market. However, its rapid expansion, questionable business model, and failure to address core governance issues ultimately led to its dramatic fall from grace. This case study explores the company’s rise, the disastrous IPO, and the lessons to be learned from WeWork’s journey.

1. The Rise: Revolutionary Idea and Rapid Expansion

WeWork’s value proposition was simple: provide flexible, collaborative, and vibrant workspaces for businesses of all sizes, from startups to large corporations. The company’s focus on community, culture, and convenience helped it gain significant traction.

- Disrupting Real Estate: WeWork didn’t just rent office space; it created shared working environments where people could collaborate and network. This concept was particularly attractive to tech startups, freelancers, and remote workers.

- Aggressive Growth Strategy: The company expanded rapidly, acquiring new locations and markets globally. By 2019, WeWork had grown to over 800 locations in 125 cities worldwide, with a valuation skyrocketing to $47 billion at its peak.

- Fundraising Success: WeWork raised billions in venture capital from major investors like SoftBank, and during this period, it was considered one of Silicon Valley’s most promising startups.

2. The IPO Disaster: The Crash of a Unicorn

In 2019, WeWork filed for its Initial Public Offering (IPO) with the aim of raising funds to fuel its aggressive expansion. However, the company’s financials, corporate governance, and business model quickly came under scrutiny, leading to the failure of the IPO and a dramatic fall in valuation.

- Financial Struggles: WeWork’s financials revealed a troubling picture. Despite its rapid growth, the company was burning through cash at an alarming rate, posting losses of over $1.9 billion in 2018 alone. The company’s model—renting office spaces long-term and leasing them out short-term—was not profitable.

- Questionable Business Practices: Investors began to question the company’s sustainability, particularly in light of CEO Adam Neumann’s eccentric leadership and self-dealing behavior. Neumann had made large personal investments in buildings leased by WeWork, which raised concerns about conflicts of interest.

- Corporate Governance Issues: Neumann’s leadership style and the company’s governance structure became key issues. He had significant control over the company, despite holding only a small percentage of shares, and his management decisions often appeared erratic. He was also found to have used the company’s funds for personal expenses, including renting a private jet.

- The Valuation Collapse: WeWork’s valuation plunged from $47 billion to as low as $8 billion after the IPO was delayed and Neumann was ousted as CEO. The failure to go public successfully was one of the most high-profile IPO disasters in history.

3. The Aftermath: Lessons in Overvaluation and Corporate Governance

The collapse of WeWork offers several valuable lessons for investors, entrepreneurs, and companies in general, especially when it comes to the dangers of overvaluation and poor corporate governance.

Key Takeaways from WeWork’s Fall

- Sustainable Business Models Are Key: WeWork’s model, which depended heavily on scaling quickly without a clear path to profitability, was unsustainable. In the world of startups, growth should not come at the expense of a viable financial strategy.

- The Importance of Corporate Governance: WeWork’s failure to address serious governance issues, such as the concentration of power in the hands of a single leader and lack of oversight, played a significant role in its downfall. Strong governance practices, including transparency and accountability, are crucial for long-term success.

- Avoiding Overvaluation: One of the most glaring lessons from WeWork’s story is the danger of overvaluation. Investors, driven by hype and the promise of rapid growth, overlooked serious flaws in the company’s business model. Valuations should be grounded in a company’s ability to generate profits and execute on its vision, not just its potential.

- The Role of Leadership: While visionary leadership can be a powerful asset, it’s important that leaders are also grounded in sound business practices. Neumann’s unchecked control and erratic behavior undermined investor confidence and contributed to the company’s downfall.

- Risk of Overhype in the Startup World: The hype surrounding startups can often lead to unrealistic expectations. WeWork’s meteoric rise and eventual collapse are a reminder of the dangers of investing in companies based on potential rather than performance.

4. The Road to Recovery: Rebuilding the WeWork Brand

After the IPO failure and Neumann’s departure, WeWork has made significant efforts to turn things around. The company has focused on cutting costs, improving its financials, and rebranding itself as a more stable and sustainable business. Key steps include:

- Cost-Cutting Measures: WeWork has sold non-core assets and restructured its operations to reduce its losses.

- Leadership Changes: New leadership has been brought in to restore investor confidence, with a focus on improving transparency and governance.

- Refined Business Model: The company is exploring new revenue streams and focusing on long-term sustainability rather than rapid growth.

WeWork’s future remains uncertain, but it continues to operate in the co-working space, adapting to market demands.

Conclusion: The WeWork Saga and Its Broader Implications

The rise and fall of WeWork serves as a cautionary tale about the dangers of unchecked ambition, overvaluation, and poor corporate governance. The lessons learned from its IPO disaster have reshaped how investors and startups approach growth, financial sustainability, and leadership. While WeWork’s story is a failure, it offers invaluable insights that can help other businesses avoid similar pitfalls.